- OWL Insights Preview

- Posts

- December 2025 Recap

December 2025 Recap

Strong month for managers focused on small caps, financials, and Europe

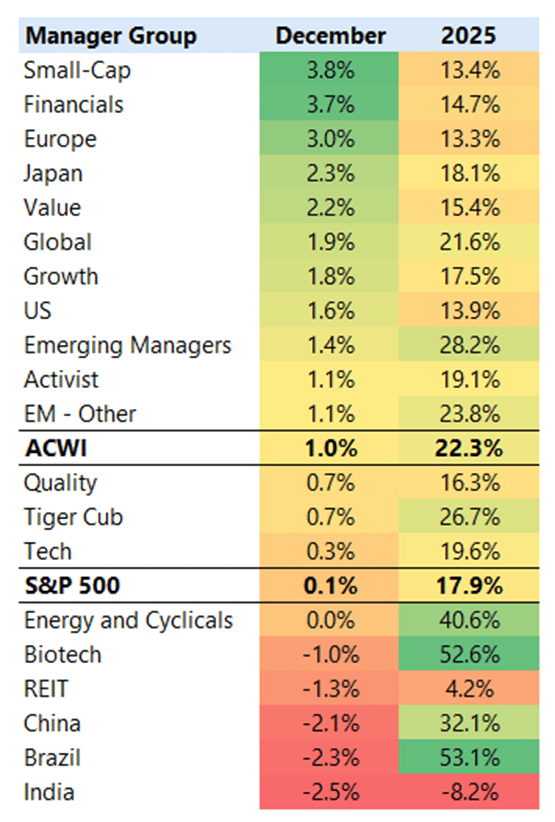

The disclosed holdings of our Small Cap, Financials, and Europe groups had strong performance in December. Managers focused on China, Brazil and India had a tough month, down more than 2%. After a strong 6+ month run, our Biotech group retreated slightly, down 1% in December. For the full year 2025, the disclosed holdings of our Biotech group remained among the strongest performers, only slightly trailing our Brazil group.

As a reminder, the table below is based on our “OWL Groups” – curated lists of over 500 managers frequently found in leading allocators’ portfolios. These lists are categorized by geography, sector, and style, enabling our users to easily monitor groups of managers and their underlying disclosed holdings. All returns shown are estimates based on publicly disclosed holdings.

Source: OWL estimated returns of disclosed longs through 12/31/25

OWL users received a detailed list of estimated manager performance on Friday. As we’ve noted in prior months, Carvana was a big driver of returns on our best performing list, with the stock up 10% in December. Carvana comprises 81% of CAS’s portfolio, 69% of Camelot’s portfolio, and 38% of Spruce House’s portfolio. As a reminder, MIT is invested in all three of those managers.

AST SpaceMobile was also a driver of returns for several managers on the list, including Broad Run (38% of its portfolio) and Once Capital Management (15% of its portfolio), with the stock up 28% in December and 235% in 2025. AST SpaceMobile is building a space-based cellular broadband network that can extend 4G/5G coverage to places with little or no cell service.

If you’d like to learn more about how to track managers’ positions with OWL, reach out!

Other News/Events

New Japan-focused hedge fund RFM raises over $800m in first year

A Dealmaking Frenzy Is Reshaping the Booming Wealth-Management Business

Energy Capital Partners set to Return $25 billion on Calpine Investment

Bridgewater to expand employee ownership after strong year for flagship fund

The Former Ice-Hockey Player Who Nailed This Year’s AI Trade

Holt exits New Mountain to create $30 billion health‑tech venture

Trinity University chalks up 12% return for year ended June 30

Syracuse University posts 10.2% return for fiscal year

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Disclaimers

Returns represent the return on invested capital of publicly disclosed long positions, as calculated by OWL. Actual returns may vary based on a number of factors, including (but not limited to) undisclosed positions, short exposure, non-equity holdings, cash holdings, and lagged disclosure of positions.

This newsletter and the material on the Old Well Labs platform are for informational purposes only and should not be considered investment advice or a recommendation of any particular security, manager, or strategy. Old Well Labs shall not be liable for any investment gain or loss that may occur from the use of this material. No part of this material may be reproduced in any form or used in any publication without express written permission from Old Well Labs.