- OWL Insights Preview

- Posts

- Managers That Struck Gold in 2025

Managers That Struck Gold in 2025

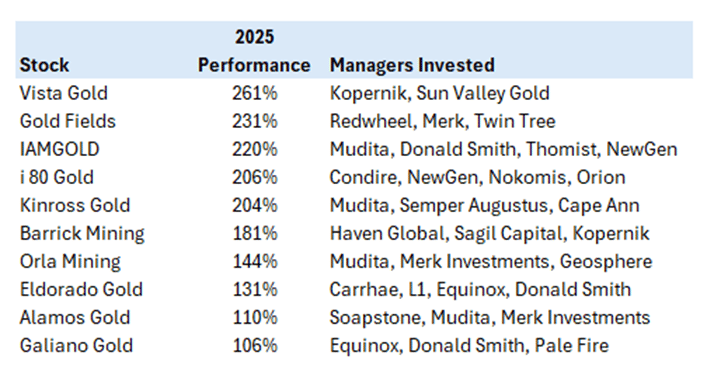

Outperforming gold stocks and the managers invested in them

Gold was a meaningful performance driver in 2025, as investors continued to use the metal as both a hedge and a portfolio diversifier amid shifting expectations for rates, growth, and geopolitical risk. While bullion exposure itself delivered strong returns, many of the most notable gains came through gold equities. This week, we highlight a handful of managers who benefited from these tailwinds in 2025. To set the stage, the table below shows a selection of gold-related stocks, along with their performance in 2025.

Source: OWL

Below, we highlight a few managers who benefited from the performance of gold stocks in 2025. All performance and exposure numbers are estimates based on publicly disclosed positions:

Condire

AUM: $1.2 billion

Year founded: 2012

Location: Dallas

Founders: Brad Shisler, Ryan Schedler

Estimated 2025 performance of disclosed positions: 76%

Basic Materials exposure: 80%; Gold exposure: 73% (includes only disclosed positions)

Backed by: Hillman Family Foundations, William Grant Foundation

Donald Smith & Co

AUM: $4.2 billion

Year founded: 1980

Location: New York

CIOs: Richard Greenberg, Jon Hartsel

Estimated 2025 performance of disclosed positions: 43%

Basic Materials exposure: 31%; Gold exposure: 23% (includes only disclosed positions)

Backed by: Idaho PERS

OWL users received additional profiles and data in Friday’s newsletter. Other managers with meaningful gold exposure include Mudita, Semper Augustus, Equinox, Helikon, and Carrhae. Harvard also bought a $200M+ position in a SPDR Gold ETF in 2025. The university has held a position in the ETF in prior years, but not since 2021.

Other News & Events

About Old Well Labs

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Disclaimers

Returns represent the return on invested capital of publicly disclosed long positions, as calculated by OWL. Actual returns may vary based on a number of factors, including (but not limited to) undisclosed positions, short exposure, non-equity holdings, cash holdings, and lagged disclosure of positions.

This newsletter and the material on the Old Well Labs platform are for informational purposes only and should not be considered investment advice or a recommendation of any particular security, manager, or strategy. Old Well Labs shall not be liable for any investment gain or loss that may occur from the use of this material. No part of this material may be reproduced in any form or used in any publication without express written permission from Old Well Labs.