- OWL Insights Preview

- Posts

- November 2025 Recap + A Look at Biotech Managers

November 2025 Recap + A Look at Biotech Managers

YTD Biotech returns + top performing Biotech stocks

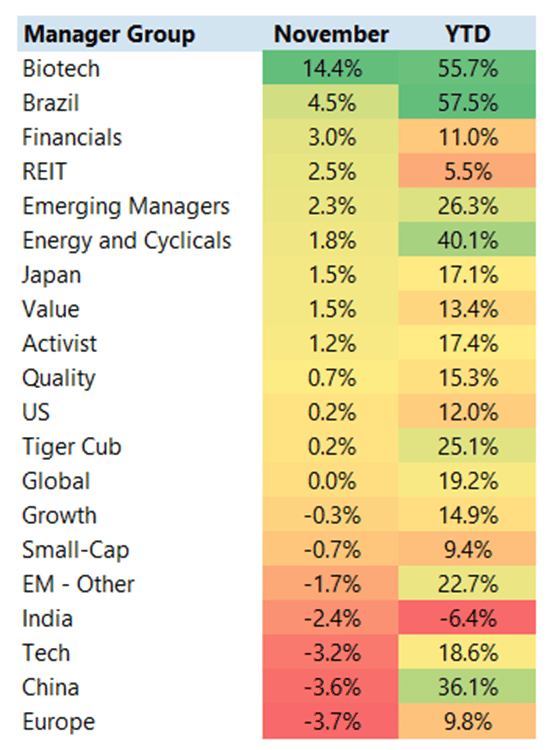

The OWL Biotech group continued its strong performance in November, up an estimated 14% for the month. Our Brazil, Financials, and REIT groups also had a good month, while Tech, China, and Europe underperformed.

As a reminder, the table below is based on our “OWL Groups” – curated lists of over 500 managers frequently found in leading allocators’ portfolios. These lists are categorized by geography, sector, and style, enabling our users to easily monitor groups of managers and their underlying disclosed holdings. All returns shown are estimates based on publicly disclosed holdings.

Source: OWL estimated returns of disclosed longs through 11/30/25

For our users, last Friday’s newsletter included a list of managers that had the best and worst performance in October. Of the 20 top performing funds on that list, 17 were biotech/healthcare focused and one (Madison Avenue Partners) is more diversified but currently has nearly 40% of its portfolio in healthcare stocks. Two of those stocks (Globius Medical and Theravance) drove the firm’s performance in November, up 50% and 38% respectively. The two non-healthcare focused managers on the top performers list were CAS and Camelot. Carvana, which was up 22% in November, currently comprises 80% of CAS’s portfolio and 70% of Camelot’s portfolio. MIT is invested in both CAS and Camelot.

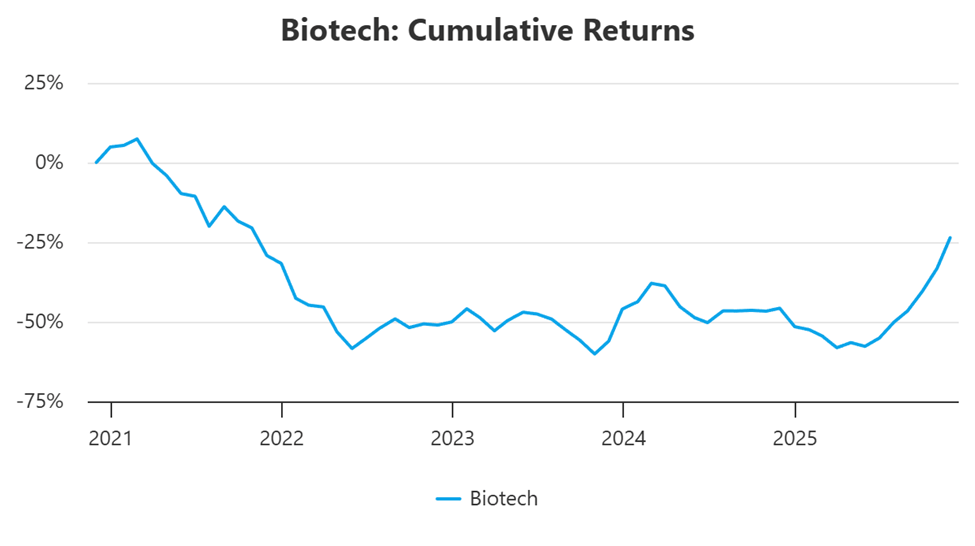

Up an estimated 14% in November and 56% YTD, OWL’s biotech group is one of the best performing groups of managers in 2025. We initially wrote about Biotech in July, just as returns were starting to pick up following a tough 4-year stretch:

Source: OWL estimated returns of publicly disclosed long positions for the OWL Biotech manager group; as of 11/30/25

Despite a tough period for returns, Biotech firms did not stop growing over the past 5 years. OWL employee data shows that total headcount at the firms in our Biotech group has increased nearly 30% since 2021. As a reminder, OWL users can see any manager’s business data (AUM growth, team growth, etc.) on the platform, helping them better understand how a manager’s business is changing over time. For our OWL groups, we’ve consolidated those business trends into a dashboard to provide an overall view for that group of managers.

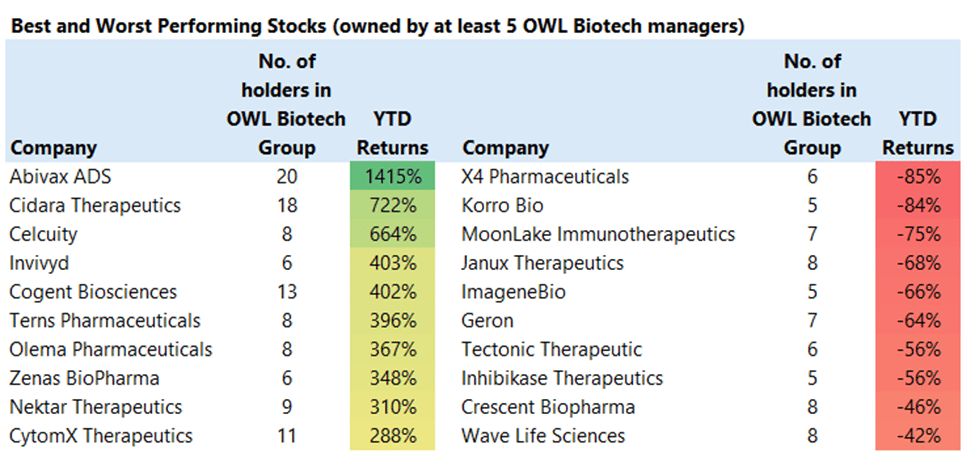

As a side note, in July we noted the impact of Abivax on Biotech manager returns, with the stock up 800%+ during the month. Since then, the stock is up another 67% and remains the top performing Biotech stock in the OWL Biotech portfolio this year, by a wide margin.

Source: OWL; stock performance as of 12/2

Other News & Events

About Old Well Labs

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Disclaimers

Returns represent the return on invested capital of publicly disclosed long positions, as calculated by OWL. Actual returns may vary based on a number of factors, including (but not limited to) undisclosed positions, short exposure, non-equity holdings, cash holdings, and lagged disclosure of positions.

This newsletter and the material on the Old Well Labs platform are for informational purposes only and should not be considered investment advice or a recommendation of any particular security, manager, or strategy. Old Well Labs shall not be liable for any investment gain or loss that may occur from the use of this material. No part of this material may be reproduced in any form or used in any publication without express written permission from Old Well Labs.