- OWL Insights Preview

- Posts

- The Mayo Clinic's Investment Portfolio

The Mayo Clinic's Investment Portfolio

Deep dive into the portfolio and an Elevation Capital profile

This week we analyze the Mayo Clinic Pension Plan’s portfolio, which has been led by Chief Investment Officer and Treasurer Paul Gorman for just over a decade, first as Co-CIO from 2015 to 2020, and then as standalone CIO from 2021 onward.

Founded in 1925, the Mayo Pension Plan serves all regular employees of the health system and maintains total assets of $11.8 billion as of 12/31/24.

Mayo’s asset allocation is below, with approximately two-thirds of the portfolio invested in external managers across public and private market strategies:

Source: Mayo pension filings as of 12/31/24

In Friday’s customer newsletter, we shared detailed lists of both public and private managers in Mayo’s portfolio.

Below is a sample of Mayo’s public asset managers. More than 35% of Mayo’s public As a reminder, in addition to Mayo’s allocator profile page, users can use our new manager search functionality to find all of the managers that a given LP is invested with. On the Managers tab, users can filter by a specific disclosed LP, as well as many other factors including location, size, business metrics (AUM growth, team growth, etc.), size of internal investment, performance of disclosed positions, etc. Below we show the manager table filtered by Mayo’s investments:

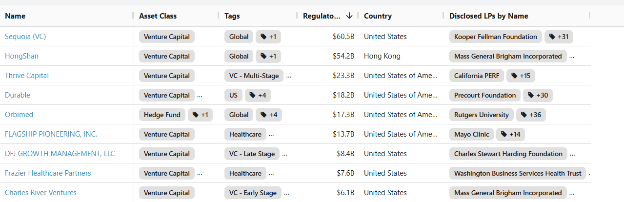

Additionally, we can create a list of Mayo’s managers filtered by asset class, highlighting its VC portfolio in this case:

Looking at business metrics, below we show Mayo managers whose AUM is growing the fastest:

Lastly, we also noticed a number of Asia-focused managers in Mayo’s portfolio. According to our estimates, at least $500 million of its investments are in Asia-focused managers (e.g., Hillhouse, Nalanda) or Asia-focused funds (e.g., Bain Capital Special Situations Asia, KKR Asia funds). Below, we show a filtered manager list with Asia-related tags:

Elevation Capital

Based in Gurgaon, Haryana just southwest of New Delhi, Elevation Capital rebranded from SAIF Partners India in 2020 with the closing of its $400 million seventh fund. SAIF has been raising India-focused funds for more than 20 years under its brand. Mayo first invested in the firm’s fourth fund and has continued to back the firm through its $670 million eighth fund, which closed in 2022.

Elevation’s AUM has remained relatively steady around $4 billion over the last few years, after meaningful growth from 2016-2021.

Source: Regulatory filings; OWL

Elevation, led by co-managing partners Ravi Adusumalli and Mukul Arora, primarily focuses on seed and Series A investments in India-based companies operating in the consumer tech, consumer brands, fintech, financial services, enterprise AI, frontier tech and healthcare industries. Other disclosed LPs include MIT, the Wisconsin Retirement System and the Lockheed Martin Pension.

It has backed 13 unicorns including food delivery startup Swiggy and online learning platform Unacademy, and has had at least four portfolio companies go public including online travel booking platform MakeMyTrip, according to its website. For more on Elevation’s 2026 outlook and focus areas, we recommend reading their 2026 Fintech Agenda, which outlines their thoughts on AI and how it will play out in India.

As a side note, partner Mayank Khanduja, who first joined the firm as an investment professional in 2011, announced two weeks ago on LinkedIn that he would be stepping down from Elevation, but hinted at a return to “new adventures” sometime in the near future. His move was also noted in a press report, which was picked up in OWL’s newsfeed (which, as a reminder, users can filter by manager).

While Khanduja is still listed as an Elevation employee on LinkedIn and on the company website, we’ll keep an eye on our team data and alerts to see if he ultimately starts his own firm.

Other News/Events

Thamesis Names Cressida Myers CEO as Family Office Roles Expand

Frazier Healthcare Raises $355M Continuation Vehicle for Accuity

Delivery Systems After $1.1B UnitedHealthcare Deal Collapses

Blackstone CEO Steve Schwarzman Plans to Build One of the Largest Private Foundations in the U.S.

Neuberger Berman to Acquire McKinsey’s Wealth and Asset Management Unit

Graham Capital transitions to single CIO structure under Foehrenbach

Cerity Partners to Merge With Investment Consultant Verus, Creating $1.3 Trillion Advisory Firm

Blackstone Merges Hedge Fund Seeding Unit Into $60 Billion Absolute Return Platform

Pershing Square Takes $2 Billion Stake in Meta, Betting on AI-Driven Growth

Texas Treasury Safekeeping Trust Company hiring Junior Portfolio Manager

OU Foundation Investments hiring Investment Manager Research Professional

About Old Well Labs

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Disclaimers

Returns represent the return on invested capital of publicly disclosed long positions, as calculated by OWL. Actual returns may vary based on a number of factors, including (but not limited to) undisclosed positions, short exposure, non-equity holdings, cash holdings, and lagged disclosure of positions.

This newsletter and the material on the Old Well Labs platform are for informational purposes only and should not be considered investment advice or a recommendation of any particular security, manager, or strategy. Old Well Labs shall not be liable for any investment gain or loss that may occur from the use of this material. No part of this material may be reproduced in any form or used in any publication without express written permission from Old Well Labs.